By Luke Britt/ Editor

Union Parish is earning substantially more interest on funds deposited with Origin Bank today than it was a week ago after the bank informed the Union Parish Police Jury on Tuesday that it was raising the interest rate on the parish’s three largest bank accounts through the end of the year.

In making that announcement, however, the Union Parish Police Jury revealed that the Landfill Assurance Trust Fund was not the only parish account with Origin Bank that for years has earned an extremely low interest rate.

According to Union Parish Police Jury President Brenda Abercrombie, Origin Bank had already affected the increase when she met with bank officials Tuesday and was informed that the bank had raised the interest rates on the Landfill Assurance Trust Fund, the parish operating account and the parish payroll account to 4.88 percent. The combined balance of the three accounts, $17.9 million, represents most of the parish’s money held in banks, and all three were earning 0.15 percent (15 ten-thousandths of a percent) prior to the rate increase, according to Police Jury records.

The rate increase follows the revelation in June that the $9.7 million Assurance Trust Fund, the parish’s largest bank account, has earned very little interest since, at least, 2017.

The Assurance Trust Fund is a state mandated account intended to ensure that funds are available to maintain the landfill for up to 30 years after it closes. The parish is required to deposit hundreds of thousands of dollars a year into that account, and because the funds cannot be used until the facility closes, it has grown into the parish’s largest account.

Members of the police jury have said they were operating under the belief that the state-mandated fund could not be modified.

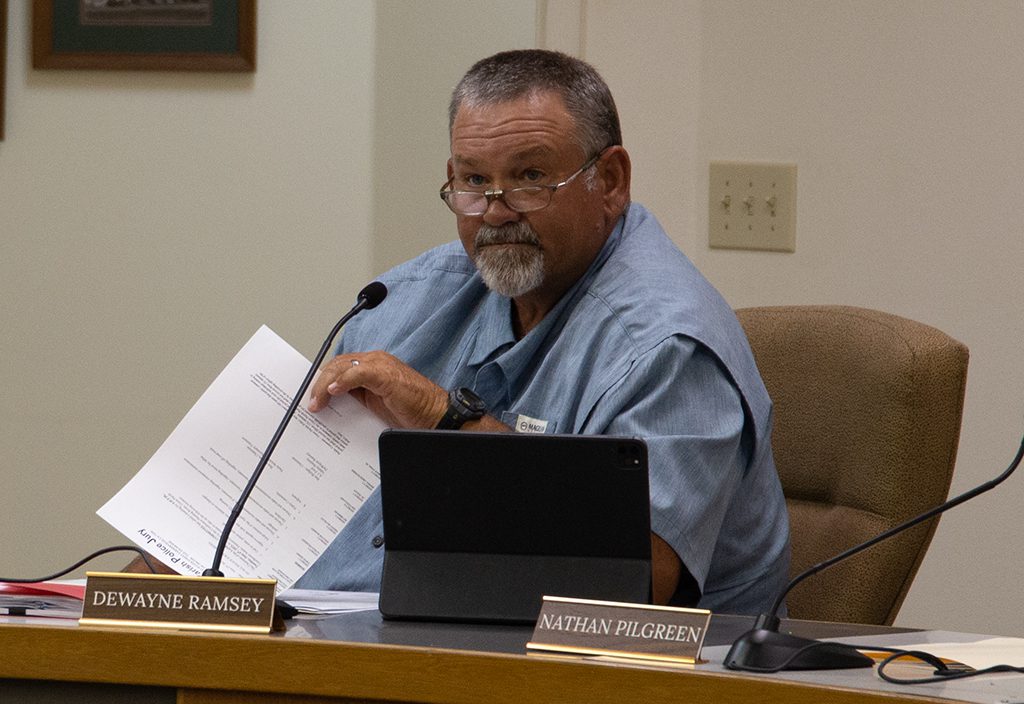

Police Jury finance committee Chairman DeWayne Ramsey, Dist. 3, said he recalls being told “on multiple occasions” that the Assurance Trust Fund could not be modified. As a result, Ramsey said, “it never occurred to us that we could get a better interest rate.”

Police Jury Finance Committee Chairman DeWayne Ramsey, Dist. 3, said the jury will be “completely open” with the public regarding the Landfill Assurance Trust Fund interest rate issue when the finance committee meets July 31. Origin Bank CEO Drake Mills is expected to attend the meeting, as well as representatives of Louisiana National Bank, which has expressed an interest in acquiring the parish’s banking business.

Which is why, in 2019, when Louisiana National Bank asked the Police Jury for a chance to compete with Origin Bank for the parish’s banking business and brought to the table a slightly better interest rate offer, the bank was told the account could not be moved.

“The whole thing traces back to us, and the jury before us, too, getting information that was not correct,” Ramsey said. “But, I don’t want to sound like I’m making excuses. It’s on us now. We’re going to fix it, and we’re going to be completely open with the public about what happened.”

Louisiana Revised Statute 39:1214 requires public funds on deposit to earn “an interest rate of not less than twenty-five percent below the discount treasury bill rate,” which currently sits at 5.25 percent. The law, however, grants an exception for “demand deposit” accounts, which are accounts from which funds can be withdrawn at any time without notifying the bank beforehand.

Last week the Police Jury asked its attorneys at the Gold Weems law firm in Alexandria to make a determination as to whether the Assurance Trust Fund qualifies as a demand deposit account, and attorney Trevor Fry responded that it is, and as such, is not bound by the minimum interest rate law.

“After meeting with (Brandon Maxwell and Drake Mills of Origin Bank) I am convinced that Origin Bank did not intentionally take advantage of the parish,” Abercrombie said. “Nor do I believe we’ve lost millions of dollars, as some have suggested. You can’t simply say we should have been earning a lot more interest all along when the account hasn’t always been as large as it is now and when interest rates everywhere were very, very low for much of this period. It’s more complicated than that.”

At the July 11 meeting of the Police Jury’s finance committee Origin Bank Executive Vice President Larry Little defended the interest rate, saying it reflected a volatile market.

The interest banks offer customers is closely linked to the Federal Reserve System’s discount rate. When the Assurance Fund was originally placed with Origin Bank on July 21, 2008, the federal discount rate was 2.13 percent, but the U.S. economy was already barreling toward the market crash that occurred on September 29 of that year. By years end, the Fed had cut the discount rate to zero, and it remained very close to zero until December 2015 when the Fed began raising the rate incrementally, usually a quarter percent at a time.

Then, Covid happened.

The Covid-19 pandemic spread across the globe in a matter of weeks during the spring of 2020. Public health officials around the world recommended lockdowns to stop the spread of the virus. Roughly 20 million U.S. jobs would be lost in April 2020 alone, with the unemployment rate jumping to 14.7 percent.

The Fed responded by cutting the discount rate to zero once again, and it stayed very close to that until March 2022. Post-Covid Federal Reserve rate hikes began slowly at first, a quarter percent in March 2022, half a percent the following May, before a series of 12 rate hikes – including three successive rate hikes of three-quarters of a percent – raised the rate to two percent, then three, then four and in May of this year the discount rate reached five percent for the first time in more than a decade.

As Origin Bank’s Little emphasized on July 11, for much of the Assurance Fund’s tenure with that bank, the federal discount rate was well below one percent. However, this does not explain why, when interest rates increased to 2.5 percent between the crash of ’08 and the Covid pandemic of 2020, the fund’s interest remained close to zero. Nor does it explain why the fund’s interest rate did not experience any of the post-COVID joy that saw the discount rate rise from .25 percent in March 2022 to today’s 5.25 percent.

Origin Bank’s Chief Communications Officer Ryan Kilpatrick said the bank cannot, by law, discuss the specifics of any customer account, but wrote in an email, “We are working with the Union Parish Police Jury to address concerns that have recently been brought to our attention. Origin has a more than a century long commitment to Union Parish, and we remain dedicated to honoring that commitment.”

On Wednesday Abercrombie said that the CEO of Origin Bank, Drake Mills, has agreed to attend a July 31 meeting of the jury’s Finance Committee to discuss the issue and make his case that Origin Bank should remain the parish’s primary bank.

Louisiana National Bank, which has expressed an interest in acquiring the Assurance Trust Fund account, will also makes its case at that meeting, Abercrombie said.

fgazette.com Community news site for Union Parish Louisiana

fgazette.com Community news site for Union Parish Louisiana